The following factors are considered when determining whether two people are in a de-facto relationship:

- The length of the relationship between them;

- Whether they have resided together;

- The nature and extent of common residence;

- Whether there is, or has existed in the past, a sexual relationship between them;

- The degree of financial dependence or interdependence, and any arrangements for financial support between them;

- The ownership, use and acquisition of their property (including property they own individually);

- The degree of mutual commitment by them to a shared life;

- Whether they care for and support children; and

- The reputation, and public aspects, of the relationship between them.

It is important to note that the above factors are not considered a check list, all of which must be satisfied to be determinative of a de-facto relationship. If you are wondering whether you are in a de-facto relationship and most of the above criteria significantly apply to your relationship, then it is likely that you are in a de-facto relationship.

Generally, where people have been together for a long time, live together, are involved in a sexual relationship and have completely intermingled finances, it follows that there will be a significant reputational or public aspect to the relationship.

Potential Implications of Declaring a De-Facto Relationship for Tax Purposes

Quite commonly, people assert the existence of a de-facto relationship on their tax return to attract some form of tax benefit. While this may have obvious tax benefits at the time, should that person make a de-facto claim against you in the Family Court, denying the existence of that de-facto relationship then necessarily means admitting a lie to the taxation office.

The sting here is twofold; not only does it become extremely difficult to deny the existence of a de-facto relationship, but the Australian Taxation Office may seek further tax payments.

A similar situation can exist when a person claims the Centrelink benefits. To be eligible for such a benefits, a person must be single and declare that they are not married or in a de-facto relationship.

Should a person later wish to bring proceedings against their former de-facto partner in the Family Court, then that may involve an admission of lying to the Department of Human Services and repaying the fraudulently obtained benefits.

If you are in a de-facto relationship and have any concerns regarding this relationship then please do not hesitate to contact one of our experienced Family Lawyers for a confidential discussion about your matter.

Need help?

Recent articles

Animal Cruelty

Bail Applications

What to do when the police arrest you?

Traffic Offences – Drink Driving

End of COVID-19 Rental Moratorium

Statutory Demand

Tobacco Smuggling

Property Laundering and Dealing with Proceeds of Crime

Common Assault

Family Law – Loans and Property

DEBT AFTER DEATH

Property Settlement After A Separation or Divorce

Family Violence Restraining Order (FVRO)

How to recover a debt that is more than $10,000?

WA Commercial Tenancies Code of Conduct

Debt Collection (1) – How to collect your debt?

COVID-19 pandemic and its impact on Corporations Law

COVID-19 Pandemic’s impact on Commercial Landlords and Tenants

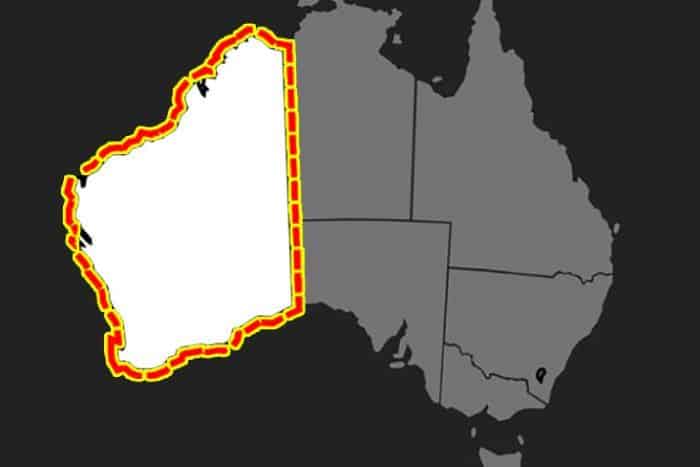

Western Australia Border Lockdown

Covid-19 (Coronavirus) and its impact on Businesses and Tenants

THREE WORKERS’ COMPENSATION CLAIM OUTCOMES THAT YOU NEED TO KNOW

Understanding Your Workers’ Compensation Claims Process

All You Need to Know About Workers’ Death Compensation

5 Step Guide to Workers’ Compensation

Probate and Letters of Administration

Parenting or Children’s Issues

Separation, Divorce, and Children’s Wishes

Did You Know That You Can be Fined for Eating While Driving?

Workers’ Compensation

Buying a Business – Lease Documentation Review and Settlement

Buying a Business – Contract Review and Business Evaluation

What is Domestic & Family Violence (3)

What is Domestic & Family Violence (2)

What is Domestic & Family Violence? (1)

Separation, Divorce, and the Division of Property

SEPARATION CHECKLIST: TOP 12 PRACTICAL THINGS TO CONSIDER

Loans to Children