Any party to a separation that involves children will have very important decisions to make. The Family Court handles disputes concerning children as well as who has parental responsibility over said children and will always put the best interests of the child first in such cases. However, the responsibility to pay child support and how much is required to be paid is usually not determined by the Family Court.

So how are child support payments determined?

In circumstances where parents have not entered into an agreement about child support payments, then it will be managed by the Department of Human Services – Child Support (it was formerly referred to as the Child Support Agency or CSA).

A child support assessment determines the amount you will pay or receive if you meet the eligibility criteria. Payments are determined by a formula. The Formula and information about the assessment process are available on the Department of Human Services website.

Essentially, the assessment of what you pay (or are to receive) is based on:

- the combined income of each parent (their adjusted taxable income), minus a self-support amount and any relevant allowances for dependents; and,

- the percentage of care each parent has for the child (or children) and the child’s age.

If circumstances change – for example: one parent takes on a new job or gets a raise, would there be an adjustment to child support payments?

Probably, but it depends on the amount by which incomes change. The Department receives information about income from the ATO. However, not everyone lodges tax returns in a timely way. The Department has a number of options to receive, or obtain, information about income, and it can make an assessment based on a provisional estimate of income from time to time. It’s best to tell the Department about changes to your income as soon as it happens. Comprehensive information about assessments and income including changes to income and the effect of that is available from the Department’s official website.

Do parents need to keep receipts for what’s been purchased on behalf of their child?

You should maintain a habit of keeping receipts for payments made on behalf of children, particularly if the expense is not covered by the child support payment or is an extraordinary payment (such as a health-related or unforeseen expense). For many separated parents, child support is administered by the Department, so if an extraordinary payment is disputed, you may need to apply to the Department to change or review the assessment.

The Department’s administrative process to sort child support payments must be followed in most cases. There are circumstances where a dispute about child support can be determined by the Family Court, but it’s not the ordinary course for the Family Court to get involved. In short though, whatever process you use, keep receipts, because the Department or the Family Court will need them in the case of a dispute.

What happens if the costs of raising a child change, such as changing schools?

We see disagreements about education and schooling arise when parents separate. The economics of separation means the affordability of schooling decisions or options made when parents were together is under stress.

The communication around expenses relating to school fees, uniforms, books, excursions, after-school care, and activities can break down and cause disputes.

Child support assessments issued by the Department don’t ordinarily cover the cost of private schooling.

Some parents enter into binding or limited child support agreements to cover additional costs such as education and health. Often, but not always, private agreements are entered into where one parent earns a high income above the capped amount, and the children are already attending or enrolled to start private school at separation, and parents have agreed to maintain private school education.

What documentation should a parent have to hand when going to Court or the Department of Human Services?

The Family Court doesn’t deal with child support for the majority of cases. It’s an exception for the Family Court to become involved. You have to go through the Department’s processes first. The best place to start is with the online application on the Department website. You answer a series of questions, and you might have to provide copies of documents such as parenting plans or Court Orders, proof of income where tax returns are not available, birth certificates and so on.

If there are other kids and other child support payments in the picture, information about them also needs to be provided. There’s a whole range of different formulas and different things to take into account with multi-child families, with different parents. The Department needs all relevant information so they can take into account the whole family situation.

Documents you might need include school enrolments, any sort of mortgage payments that might be made to house the children, or travel receipts if the parent has to travel or spend money for accommodation to exercise time with the children.

The child support amount is calculated on the basis of a statutory formula. The assessment is reviewed every year by the Department. The Department calculates what it costs to raise a typical child, or children when there is more than one child, and these costs are set out in tables on the Departments website.

The average member of the public isn’t expected to know any of the formulas. Once your information is submitted the Department produces an assessment. It’s useful to know some elements of the process and to know what is taken into account in determining an assessment. The tables setting out the self-support amounts, costs of care calculations for children at different ages are available on the Department’s website.

Can grandparents or other family members or even non-related people apply for child support if they happen to become the primary carer?

Yes. The eligibility criteria cover grandparents and some other non-parent carers. It’s not uncommon for grandparents to care for their grandchildren when parents are unavailable for whatever reason.

If you have any questions in relation to Child Support or any parenting related issues, please contact one of our friendly team members to address your concerns.

Need help?

Recent articles

Animal Cruelty

Bail Applications

What to do when the police arrest you?

Traffic Offences – Drink Driving

End of COVID-19 Rental Moratorium

Statutory Demand

Tobacco Smuggling

Property Laundering and Dealing with Proceeds of Crime

Common Assault

Family Law – Loans and Property

DEBT AFTER DEATH

Property Settlement After A Separation or Divorce

Family Violence Restraining Order (FVRO)

How to recover a debt that is more than $10,000?

WA Commercial Tenancies Code of Conduct

Debt Collection (1) – How to collect your debt?

COVID-19 pandemic and its impact on Corporations Law

COVID-19 Pandemic’s impact on Commercial Landlords and Tenants

Western Australia Border Lockdown

Covid-19 (Coronavirus) and its impact on Businesses and Tenants

THREE WORKERS’ COMPENSATION CLAIM OUTCOMES THAT YOU NEED TO KNOW

Understanding Your Workers’ Compensation Claims Process

All You Need to Know About Workers’ Death Compensation

5 Step Guide to Workers’ Compensation

Probate and Letters of Administration

Parenting or Children’s Issues

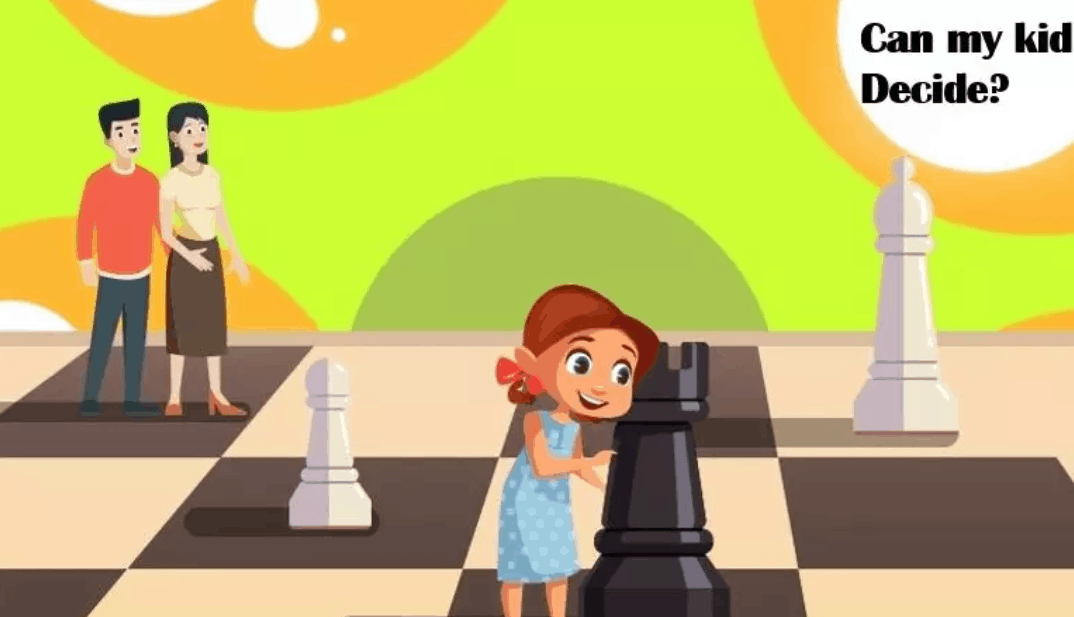

Separation, Divorce, and Children’s Wishes

Did You Know That You Can be Fined for Eating While Driving?

Workers’ Compensation

Buying a Business – Lease Documentation Review and Settlement

Buying a Business – Contract Review and Business Evaluation

What is Domestic & Family Violence (3)

What is Domestic & Family Violence (2)

What is Domestic & Family Violence? (1)

Separation, Divorce, and the Division of Property

SEPARATION CHECKLIST: TOP 12 PRACTICAL THINGS TO CONSIDER

Loans to Children